Five sustainable investing myths

Given the dramatic rise in popularity of sustainable investing, it’s perhaps no surprise that a few misconceptions have come along for the ride.

Sustainable investing – sometimes known as “ESG” investing because it considers environmental, social and governance risks and opportunities – has become increasingly important.

Last year our employer Schroders found two-thirds of investors had increased their sustainable investments over the previous five years.

However the Global Investor Study 2018, a survey of more than 22,000 investors, also suggested many are confused about what related terms mean.

More than half (57 per cent) said a lack of information was the reason they don’t invest more in sustainable investments or have them in their portfolio.

We’re here to bust some myths about sustainable investing so you can better understand your options and their impact.

Myth 1: Sustainable investing is only about protecting the environment

Yes, the “E” of “ESG” is indeed “environment”, but sustainable investing is about more than just protecting physical aspects of the planet.

It is about encouraging companies to properly consider the impact of environmental issues. But this could mean analysing how consumers becoming more aware of their carbon footprint will impact long term business strategies for airlines, for example.

The “S” and “G”, (“social” and “governance”), are also fundamental to sustainable investing.

Socialfactors could be considerations such as demographics, data security, or nutrition and obesity or how well a company looks after its employees, for instance.

Governance factors relate to the internal policies and processes companies have designed to ensure management acts in the best interests of its shareholders.

Myth 2: Sustainable investing is simply NOT investing in something (or “screening” investments)

Yes, there are investment products that make a point of ONLY or NOT investing in certain types of companies or industries.

This is “screening” or “positive indexing” and these investments are mostly referred to as “ethical” or “socially responsible investments” (“SRI”). What is considered ethical or socially responsible is determined by an investor or group of investors’ own principles or beliefs, for example religious beliefs.

Sustainable investing, on the other hand, is a broad investment approach that is considered at all stages of the investment process.

From choosing what to invest in to monitoring and engaging with investee companies and adjusting forecasts, it can take many forms including “thematic investing”, “impact investing”, “active ownership” and more.

Thematic investing involves investing in companies that can be grouped under a particular investment theme such as renewable energy, waste and water management, education or healthcare innovation.

Impact investing aims to achieving specific, positive social benefits while also delivering a financial return. Impact investments create a direct link between portfolio investment and socially beneficial activities. Historically most of the activity has occurred in unlisted assets (i.e. investments that are not traded on the stock exchange).

Read more:

– Six things I’m doing to live more sustainably

– Three millennial money trends

– Festivals turn up the volume on sustainability – but we need to too: My tips for being a greener festival-goer

Active ownership, through voting and engaging with companies, instead of just divesting, is a big part of sustainable investing.

As owners of their shares, investors have the right to vote on company issues and engage with management in order to protect and enhance the value of investments.

The focus can be on anything that has a material impact on a company’s success and could include business practices, management, executive compensation, or policies related to climate change, the environment or social issues.

Myth 3: Sustainable investing is all about an investor’s values, not good performance

Sustainability analysis, when integrated with more traditional methods of measuring a company’s prospects, has the potential to improve judgment and enhance performance.

It has been suggested firms that consider ESG issues can increase returns and/or reduce risks compared to those that don’t. Research from the Journal of Sustainable Finance & Investment and more recently Morningstar Financial Research, a fund research company, supports this.

Morningstar Financial Research compared the performance of their ESG-screened indices to their non-ESG equivalents and found that 73 per cent of the ESG-screened indices outperformed their non-ESG equivalents.

Consumer perceptions from the Global Investor Study 2018 also counter this myth. Only one in four respondents believed that sustainable investment products do not offer as profitable returns as non-sustainable investments.

This makes sense because ensuring companies, industries or markets are operating within their means and maintaining stability over the long term is about their long term performance.

It might mean excluding certain companies or industries on the basis that they face deep-seated problems that make them poor long-term investments.

Considering sustainability factors should allow investors to better assess the long-term potential of investments and identify the performers that’ll help them meet their financial goals.

Of course, they still have to consider that the value of investments and the income from them may go down as well as up. They may not get back the amounts originally invested.

If you are unsure as to the suitability of any investment speak to a financial adviser.

Myth 4: Sustainable investing is just for millennials

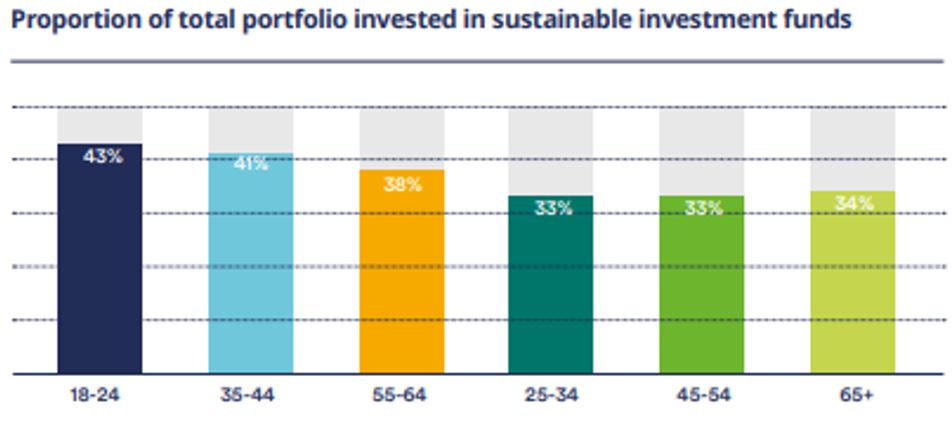

Interest in sustainable investing spans age groups. Millennials are leading the demand and are allocating an average of 41 per cent of their portfolios to sustainable investments, according to Schroders’ 2018 Global Investor Study. But across all age groups people still allocate at least 30 per cent to sustainable products overall.

Source: Schroders Global Investor Study 2018

Myth 5: Sustainable investing is only applicable to equities (i.e. stocks or shares)

We tend to think mostly about equities, but it doesn’t end there. With bonds, for instance, ESG analysis helps identify risks to a borrower’s ability and willingness to repay debts that may have otherwise gone unnoticed.

Put simply, a well-managed company should be less likely to stumble into value-destroying disasters, meaning their returns are more stable and they are better positioned to repay investors.

With the private equity asset class – i.e. companies that are not publicly-traded – capital is locked up for years. Considering ESG factors here is crucial as investors want to be confident that companies are managing future or long-term risks that may not have materialised yet. Private companies also face less regulatory oversight, so analysis of their corporate governance can provide important insights to private equity investors.

- This post first appeared on MoneyLens, a website created by Schroders’ millennials aimed at helping millennials

Important Information: The views and opinions contained herein are of those named in the article and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This communication is marketing material.

This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 1 London Wall Place, London, EC2Y 5AU. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.