Banks could be forced to fork out billions over undisclosed PPI commission following mis-selling ruling

British banks may have to dole out billions more on mis-sold payment protection insurance (PPI) claims following a landmark legal ruling.

Many of the UK's leading banks have ringfenced sums to compensate those who were mis-sold PPI, which was designed to cover repayments in circumstances such as redundancy, illness or death. The mis-selling scandal has so far forced banks to dish out up to £30bn in compensation.

The case today relates to a couple, Christopher and Jane Doran, who said they were entitled to receive compensation over the commission earned by their provider, Paragon Personal Finance.

The regulator, the Financial Conduct Authority (FCA), advised banks that only commissions above 50 per cent of the premium value were unfair and they should pay out only the amount of commission above that benchmark.

Read more: FCA's guidelines are undervaluing consumers' PPI claims by billions

The commission received by Paragon Personal Finance amounted to 76 per cent of the PPI premium, or £7,985.46. The bank was ordered to pay it in full, rather than the 26 per cent that the FCA advised they would be liable to pay.

The commission claims stem from an earlier landmark court ruling known as Plevin, in which customers can now claim money back if their provider earned a high level of commission from their PPI that was not disclosed on taking out the policy.

The number of potential Plevin claims is understood to be significantly less than the 13m complaints that have been upheld for mis-selling in general.

Firms were required to write to about 1.2m customers who’d had their complaint rejected for mis-selling but may have be entitled to complain under Plevin rules. Customers who win redress for mis-selling can’t then complain under Plevin rules, and firms are only required to consider claims for undisclosed commission if the complaint is rejected for a mis-sale.

A spokesperson for Paragon Banking Group, which owns Paragon Personal Finance, said: “We believe this decision is at odds with other cases heard recently and does not create a precedent. The Doran case is one of a handful of legacy cases for Paragon and we are considering our position regarding appeal.”

The FCA said it accepted courts might take a "variety of approaches to redress on individual cases" regarding Plevin but that it thought its approach was "fair and appropriate".

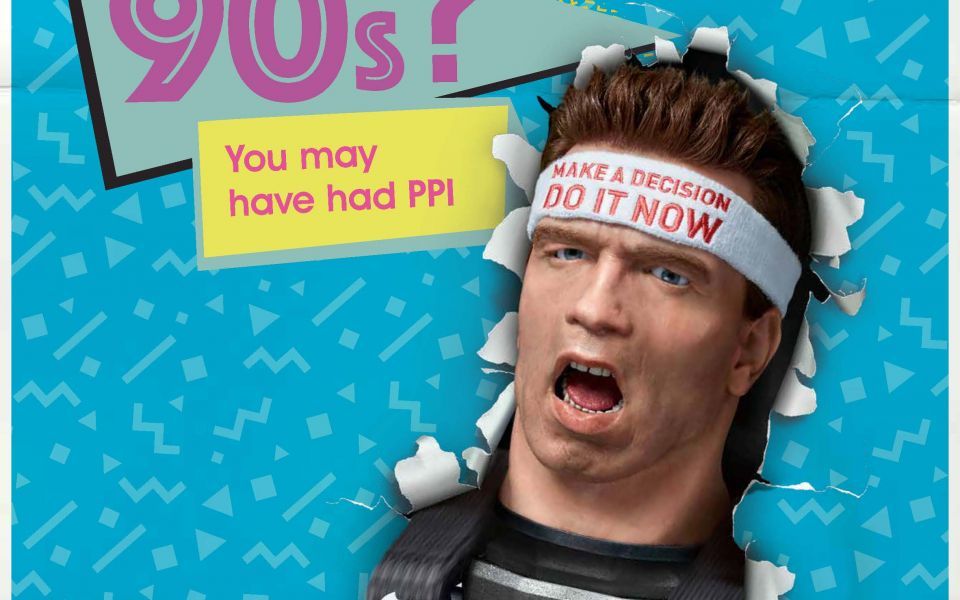

Read more: The Terminator delivers £3bn hit to big banks as PPI costs rise further